Life Goal Planning

What? Why? Benefits?

MONDIAL MMX Financial is in mission of offering personalized Life Goal Planning service to its clients to enable them reach Financial Security and Financial Independence.

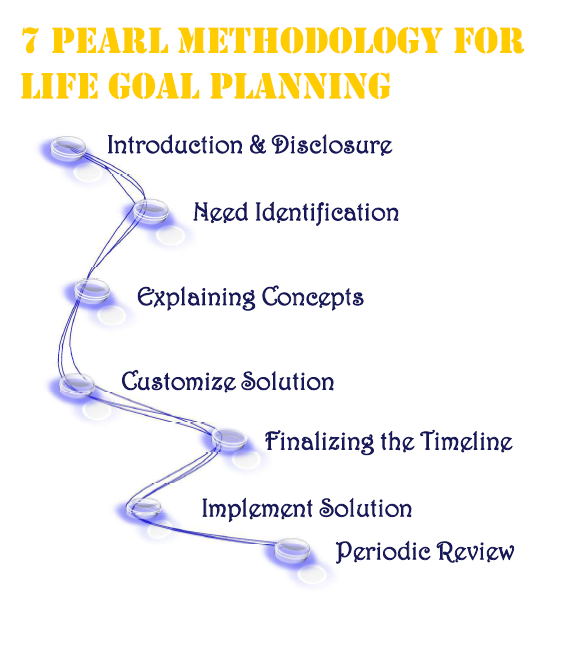

MONDIAL MMX Financial follows "7 pearl methodology" which is invented through academic validated Life Goal planning process combined with 20 years experiences of understanding clients needs.

Generally an individual deals with financial intermediary like agents, brokers, Tax consultants etc. This result in he is getting the advice only from that angle in which his Financial intermediary has got expertise.

It is a Life Goal Planner who looks at his Finances from all the angle through his holistic Life Goal Planning approach and then advices him considering his benefit in mind & best approach to fulfill his need.

What is Life Goal Planning?

Life Goal Planning is a process that can help you reach your goals by evaluating your whole financial situation, then outlining strategies that are customized to your individual needs and available resources. One of the main benefits of having a Life goal plan is that it can help you balance conflicting financial priorities. A Life Goal Plan will clearly show you how your financial goals are related; for example, how saving for your children's college education might impact your ability to save for retirement. Then you will use the information you've gathered to decide how to prioritize your goals, implement specific strategies, and choose suitable products or services. Best of all, you'll have the peace of mind that comes from knowing that your financial life is on track.

Why Life Goal Planning?

You almost certainly have plans - starting a family, buying a primary or secondary home, retiring, or maybe annual vacation - but have you looked into the financial implications of turning those plans into reality?

The sooner you start financial planning, the better chance you have of realising your goals.

Benefits of Life Goal Planning

✔ Helps you understand your present Financial standing ✔ Helps you eliminate the drawbacks in present method of Money management ✔ Helps you evaluate your capability to fulfil your needs in desired time schedule ✔ Help protect and grow your savings & investments in a tax efficient way. ✔ Protect dependents and income from the unexpected and the unwelcome events. ✔ Increase the after-tax legacy you pass on to your beneficiaries.

Cash Flow and Debt Management Planning

A positive cash flow is the pre requisite for savings that can be invested to create wealth for you. We will analyze your current cash flow scenario, project the future cash flows and provide you the strategies to increase your cash flow. We will analyze your present borrowings and help you weed out the ones that prevent you from becoming wealthy. We will analyze your future borrowing requirements and provide you right strategies that help you plan your tax and increase your wealth.

Tax Planning

An important part of any retirement and investment plan is the way you deal with tax. Obviously you want to pay as little as possible, not just now but in retirement too.

That means making the most of all the tax breaks available to you - claiming any Family Tax Credits you are entitled to and utilizing where appropriate your annual Capital Gains Tax Allowance. When saving for the future you need to balance carefully between paying into any tax-free savings vehicles. Our advisers will help you negotiate this technical minefield and ensure your investments are set up in the most tax-efficient manner.

Contingency Planning

Planning for Contingencies is an integral part of any Goal Achieving Plan. Contingencies can result in reduction or stoppage of one's income. But regular living expenses need to be taken care of anyway. So, a well thought out and planned Contingency Fund for such situations can be a great help. Contingencies can arise due to many reasons like Job loss, health problems, temporary Disability, etc. A Corpus equivalent of 3-6 months of Living expenses plus committed outgo kept in liquid form is highly recommended.

MONDIAL MMX helps you in identifying the Contingencies and the most suitable option to take care of it. These options are managed regularly and reviewed periodically through our review process as part of "7 Pearl Methodology for Life Goal Planning"

Investment Planning

Investment planning is a critical process which helps you reach your financial goals. There is no standard portfolio or solution which works for all. The right solution is the one which works the best as per your Risk appetite & fulfil your Financial goals in the best possible manner. MONDIAL MMX helps in designing this customized solution specially for you.

Timing the market & counting on your luck might not be the best strategy to fulfil your Financial goals. Life Goal Planning will help you to reduce your dependency on luck and timing.

MONDIAL MMX will guide you safely through the jungle of Financial products. Our investment suggestions and strategies will be focused on fulfilment of your Life goals in the best possible manner & will not get carried away by market trends. MONDIAL MMX suggested investment solutions are ...

✔ Customized according to your goals, existing portfolio, life stage and time horizon. ✔ Designed to meet your goals matching your risk tolerance level. ✔ Designed to meet your needs of liquidity. ✔ Designed to give you superior post inflation return. ✔ Taking into account the effect of income tax. ✔ Based on proven asset allocation strategies and required diversification. ✔ Continuously reviewed and rebalanced on need basis keeping in mind its end goal.Investing with protection

'Risk' doesn't have to be as daunting as it sounds - it's not simply about potential capital losses. Riskier investments can offer the potential for a greater potential return, although this does not always follow. Conversely, the higher the risk, the greater the danger of suffering substantial losses.

The key to managing risk versus return is to have a balanced portfolio - one that is exposed to a variety of asset classes, some risky and some less so.

Our Life Goal Planning can help you decide how much risk you are prepared to take with your money; taking into account the amount of loss you're able to tolerate practically, emotionally and financially, and make recommendations that you feel comfortable with in terms of investing for the future.

Investing for income

Most people aren't investing enough for their future. Due to the rise in life expectancy the need to ensure that you have enough income in retirement is greater than ever. More than ever the onus is now on the individual to provide for their retirement.

With years of experience behind us, our Life Goal Planning can help you invest with the aim of generating an income. As with all our recommendations, the level of risk, potential return and involvement you prefer; solutions will be custom tailored to your needs.

Lump sum or regular saving?

If you've just received a lump-sum amount or want an easy, flexible and efficient way of building up your investments, plan a meeting with us. We can discuss your medium and long term plans and recommend ways of investing your money and generating growth.

We have relationships with a selection of preferred partners providing Financial Products or Services. Due this we are able to select the best product available to full fill your requirements and desires. Through these relationships, we can provide you the Product & Services like Life Insurance, Non-Life Insurance, Mutual Funds, PMS, Fixed Deposits, Loans, Property, Wills and many more.

Our criteria for relationship with Financial product providers are based upon their financial strength, value for money, customer service and most importantly, competitive product and service features. In addition, we have access to our in-house investment specialists in each category.

Our Life Goal Planners will establish which regular or lump sum investment options are suitable for your requirements and recommend a solution accordingly.

Risk Management and Insurance Planning

While the basic need one has to fulfill is Food, Clothes & Shelter, a proper Risk management is also part of it.

An Individual faces several types of risk – Loss of Life, Disability, Ill-Health, Critical Illness, Damage to Property, Third party Liability, Professional Liability are some of them. We will help you identify the risks you face and its various parameters.

✔ Type of Risk ✔ Quantum of Risk ✔ Duration of RiskHaving done that, we provide a Cost-Effective Strategy to manage the risks with the best option available.

Kids Education Planning

As a parent, you'll want your children to get the best start in life. Our Life Goal Planning Managers can guide you through the entire family Life Goal Planning process, and make recommendations from a selection of market-leading providers. We'll help to make sure that you've considered all relevant factors, so you can end up with quality solutions that are right for your circumstances.

We can work with you to plan for a new addition to the family, education costs, a gap year, the deposit on a first home and wedding expenses. If you're a grandparent, through a combination of expert advice and the ability to introduce you to a specialist tax professional, we can advise you on the tax-efficient benefits of making gifts, helping when possible to ensure that you pass your wealth on to your family, rather than the taxman.

Whatever your situation, we'll help you prepare your finances so that, as they grow up, you can give your children and grandchildren all the support they need.

Retirement Planning

We help determine how much money you need to realize your retirement goals. We will devise strategies to fund savings and investment. We will devise investment strategies that leverage your savings. As you approach retirement, we will develop strategies to convert savings into the income you need to live on.

You may have existing pension plans in place, like a company pension or personal pension plans. Perhaps you're just starting to save, are ready for retirement or retired already. Whatever your situation, our Life Goal Planners can draw on a range of investment options from market leading providers, to create a retirement plan that's tailor-made for you.

We'll listen to your ambitions for your retirement and help you select the most suitable form of retirement planning solution.

We can work with you to decide how much to put aside, and recommend what investment opportunities are right for you. We can also advise on what steps you should take to keep your pension plans up to date. So you can feel secure in the knowledge that you have taken steps to help turn your dreams of retirement into reality.

There are more ways than ever to save for retirement. And how much you invest now can make a fundamental difference to how much freedom you have later. Our Life Goal Planners can work with you to determine how much you should be, and can afford to be saving. They can advise on the retirement preparation that best suits your attitude to investment and your dreams for the future.

If you're already contributing to an employer's scheme, or have other personal pension arrangements you could consider topping them up. If you have no pension plans in place, it's a good idea to start now. We can guide you through the options available. And once you've got started, we can help make sure your retirement preparation continues to head in the right direction. True financial freedom is something that can be achieved only by careful planning. Not every one wins a huge lottery or receives big inheritance. Increasing cost of health services and detrimental effect of inflation will make your carefully built retirement corpus seem insufficient to sail through the retirement period without hitting air pockets.

Today's workplaces are virtual pressure cookers. How long would you sustain the pressure without your health being affected? What if you are forced to seek early retirement, say in you forties instead of fifties. You will have longer retirement period than working period! Will you be ready then?

You need to take care of your and your dependents needs all by yourself. What if you are disabled and have to depend on others? Lack of adequate infrastructure for long-term care puts additional burden. We are fast loosing the safety net provided by joint family as more and more families are going nuclear. Children migrate to greener pastures and you are left to fend for yourself. Women outlive men and if not provided adequately may have to compromise the standard of living. Increased life expectancy puts it's own burden on retirement planning.

When you must start retirement plan? It's quite common for a young earner to exclaim "What retirement? It's still far away. Let me enjoy now". Period between now and the faraway event is the right period to build the retirement corpus and the right time to start is now. Not starting early makes the goal more difficult to achieve. The surest path to follow is to start saving early, do so regularly, and invest the savings wisely. This allows assets to grow with time into the nest egg you will need to fund the lifestyle you desire.

Estate Planning

You would be on process of creating wealth through our Life Goal Planning process or would have already got some. Managing of wealth also means the need to transfer it properly to your legal heirs. Planning of creating wealth also demands another planning of transferring it with least resistant.

MONDIAL MMX with its knowledge of Legal & Taxation subjects will help you take care of the how the wealth created is being transferred to the legal heirs you want to transfer without much hassles.

For Corporates

Top Management

The Top management of the corporate is responsible for running of the company. Due to heavy responsibility & stress-full task, they are not able to take care of their finances in best possible manner. If they start spending good time in managing their personal finances, it might result in inadequate time for managing corporate activity.

To take care of the situation, we offer our Life Goal Planning Process for the top management to the Corporate. The aim is to create a Win-Win situation for both Corporate & its Top Executives. The executives get the assurance of best practices being used in managing their finances through our competent Life Goal Planners & the Corporate gets the maximum attention by its Top executives.Middle Management and Executives

We provide On-site and/or Off-site 'Investment Helpdesk' for the Middle Management and Executives of the corporate as per their needs. The services offered through the Investment helpdesk include Tax Planning, PAN Facilitation, Tax Returns preparation & filing and access to various Tax Saving and Investment Instruments. The service offering of our Investment help desk can be customized to suit each corporate requirement.

The Investment Helpdesk can be even extended to Life Goal Planning Process Service on one-on-one basis.Workshops and Seminars

Many company employees, and particularly company executives, face a capital accumulation crisis. Company jobs often are demanding and leave little time for recreation and family and still less time for personal financial pursuits. While seemingly generous, company salaries often are taxed higher than comparable incomes of self-employed individuals and business owners. This is because self-employed professionals and business owners usually have more deductions they can reasonably take before paying income tax. Furthermore, the Provident Fund is not likely to be a significant capital accumulation vehicle for highly paid employees. As a result, higher-paid employees tend to rely too heavily for capital accumulation on various plans to acquire their own company's stock if such option is available. This violates a cardinal rule of investing -- achieve adequate diversification. To complicate matters further, an unsuccessful accumulator of capital will be a victim of inflationary trends; that is, it will cost more and more to support a given lifestyle. We conduct seminars and workshops to corporate employees on topics like Life Goal planning, tax planning, savings and investment, stock purchase plans, stock options and other Life Goal planning products and services. This can be customized to meet particular requirements of each corporate entity.